Wärtsilä order intake up 16% for FY2023

01 February 2024

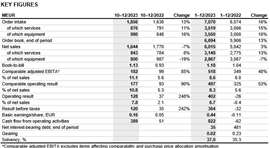

Wärtsilä, a global provider of technologies and lifecycle solutions for the marine and energy markets, reported a 13% order intake increase to EUR 1,856 million in the period from October to December 2023. Service order intake grew by 11% to EUR 876 million, while net sales decreased 7% to EUR 1,644 million compared to the same period in the prior year.

Wärtsilä saw order intake increase by 13% to EUR 1,856 million from October to December 2023, with a full year increase of 16% to EUR 7,070 million. (Source: Wärtsilä)

Wärtsilä saw order intake increase by 13% to EUR 1,856 million from October to December 2023, with a full year increase of 16% to EUR 7,070 million. (Source: Wärtsilä)

For the full year (January-December 2023), Wärtsilä reported a 16% increase in order intake to EUR 7,070 million, with 22% organic growth. Service order intake grew 15% increase to EUR 3,519 million. The order book at the end of the period increased by 13% to EUR 6,694 million. Net sales for FY 2023 grew 3% to EUR 6,015 million. Cash flow from operating activities increased to EUR 822 million.

“In 2023, Wärtsilä continued to develop positively in many ways. Our financial performance improved steadily throughout the year, and we achieved all-time highs in order intake, net sales and cash flow from operating activities,” said Häkan Agnevall, president & CEO, Wärtsilä. “We improved our profitability through growing services, improving the quality of revenues and progressing in turning around Energy Storage & Optimisation and former Voyage operations. We mitigated the headwinds from cost inflation, geopolitical concerns and a slowdown of global economic growth.”

Agnevall went on to note that the company’s engine power plants business saw a significant increase in business in the fourth quarter following a slow first three quarters in 2023. “As an example, we signed a contract to supply two 30-MW power plants for Indonesian state-owned utility PLN, each of them operating with three Wärtsilä 31DF dual-fuel engines,” he pointed out.

Wärtsilä believes its solutions, such as methanol engines, “can make a real difference” as the marine industry accelerates its decarbonization transition. (Photo: Wärtsilä)

Wärtsilä believes its solutions, such as methanol engines, “can make a real difference” as the marine industry accelerates its decarbonization transition. (Photo: Wärtsilä)

“In the marine market, the investment appetite for new ships remained healthy in 2023, despite capacity limitations at the main shipyards in South Korea and China and further increases in newbuild prices,” he continued. “In July, the International Maritime Organisation (IMO) updated its strategy on cutting greenhouse gas emissions from ships, with a more stringent goal of reaching net zero emissions by or around 2050. As a result, stakeholders are now more aligned globally on the requirements and investments needed to decarbonize the industry. This will accelerate the decarbonization transition in marine where Wärtsilä solutions can make a real difference.”

Services accounted for 52% of the company’s net sales, and Agnevall said he foresees additional growth opportunities. “Around 30% of our installed base is now under agreement coverage, and we are very proud that the customer renewal rate for our agreements is around 90%.”

Wärtsilä expects the demand environment for both the marine and energy sectors over the next 12 months (Q1/2024-Q4/2024) to be better compared to the same period in 2023.

“We are on a clear path to reach our financial targets. Key drivers for reaching our profitability target will be to continue moving up the service value ladder, increasing the profitability of Energy Storage & Optimisation and continuing the divestments of our Portfolio Businesses,” Agnevall stated. “Wärtsilä is an established technology leader in the decarbonization transformation. We can make a difference in our industries and the world, while securing our financial performance and delivering attractive long-term shareholder value.”

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

POWER SOURCING GUIDE

The trusted reference and buyer’s guide for 83 years

The original “desktop search engine,” guiding nearly 10,000 users in more than 90 countries it is the primary reference for specifications and details on all the components that go into engine systems.

Visit Now

CONNECT WITH THE TEAM