OEM manufacturing technology purchases grow by 16.1%

12 October 2023

Source: AMT – The Association For Manufacturing Technology

Source: AMT – The Association For Manufacturing Technology

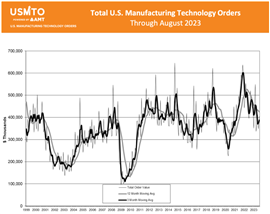

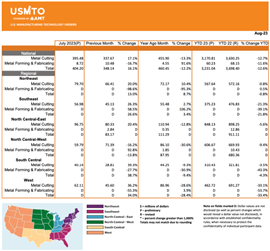

August 2023 saw new orders of manufacturing technology increase by 16.1% from the prior month, reaching a total value of $404.2 million, according to the latest U.S. Manufacturing Technology Orders (USMTO) Report published by AMT – The Association For Manufacturing Technology. The report provides regional and national U.S. orders data of domestic and imported machine tools and related equipment and serves as a leading economic indicator as manufacturing industries invest in capital metalworking equipment to increase capacity and improve productivity.

New manufacturing technology orders grew by double digits on a month-over-month basis, but were 12.2% below August 2022. Year-to-date orders reached $2.23 billion, 12.6% lower than the first eight months of 2022.

“We are seeing industries focused on shorter-term projects reduce their spending, but at the same time, OEMs focused on longer-term production timelines have been increasing their spending, keeping orders at an elevated level,” said Douglas K. Woods, president of AMT. “The net result is that for the third consecutive month, the gap between year-to-date orders in 2022 and 2023 has narrowed, falling from a 14.6% deficit in May to the 12.6% difference we see today.”

Source: AMT – The Association For Manufacturing Technology

Source: AMT – The Association For Manufacturing Technology

Manufacturers of engines, turbines and other power transmission technologies are increasing orders at a rapid pace. According to the report, the current upward trend is the largest sustained increase in orders since that seen in summer 2008, when tehy were driven by the transition from coal-fired power plants to electricity generated by natural gas turbines.

“Much of the spike in demand for manufacturing technology over the last few years can be traced back to elevated consumer demand,” said Wood. However, he cautioned, “To gauge the probable path of manufacturing technology orders in the future, we should keep an eye on the health of consumer spending. Between mortgage payments becoming a larger share of discretionary income, wages in many industries not keeping pace with inflation and ongoing labor disputes shuttering production lines, there are still several headwinds that face both consumers and the manufacturing technology industry.”

The value of orders by job shops remained well below historical trend despite an elevated share of unit orders. The report said this indicates that while job shops are continuing to buy to increase capacity, OEMs are increasing their purchases of specialized machinery to make more complex, higher-value parts. Of OEMs increasing orders, manufacturers of automotive transmissions have increased for yet another month, marking the highest three-month streak since June to August 2017.

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

POWER SOURCING GUIDE

The trusted reference and buyer’s guide for 83 years

The original “desktop search engine,” guiding nearly 10,000 users in more than 90 countries it is the primary reference for specifications and details on all the components that go into engine systems.

Visit Now

CONNECT WITH THE TEAM