Forecast 2023: U.S. machinery sales uncertainty after solid first half

07 October 2022

This forecast originally appeared in the September 2022 issue of Diesel Progress.

When I glance back to a year ago, 2021 staged one hell of a rebound from 2020’s slowdown, when the COVID-19 pandemic rendered the economy largely comatose. The only saving grace in 2020 was the compact machinery sales that fed the ravenous demand of the housing market and offset much of the pain in other equipment segments that slumped more than 20% from 2019 levels.

Manufacturing did its best to ramp up production to meet the strong demand that permeated North America. However, output was curtailed by supply chain issues that were a byproduct of the lockdown period. Raw materials and essential parts became much harder to acquire as global production and distribution weakened, which limited the supply side of the equation and led to price hikes from top to bottom.

Machinery sales would have been much more robust last year if the supply chain factors had picked up where they left off prior to the pandemic. Because of the global supply chain woes, order backlogs at dealers ramped up dramatically and pushed into 2022. By early Spring 2022, backlogs of equipment continued pushing out even further into 2023 as supply problems remained in place while demand in the housing markets surged upward.

Mirroring 2021

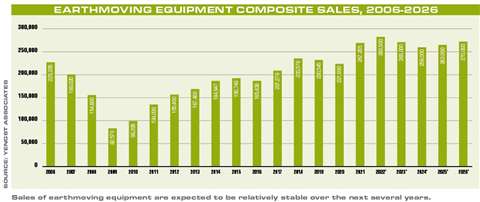

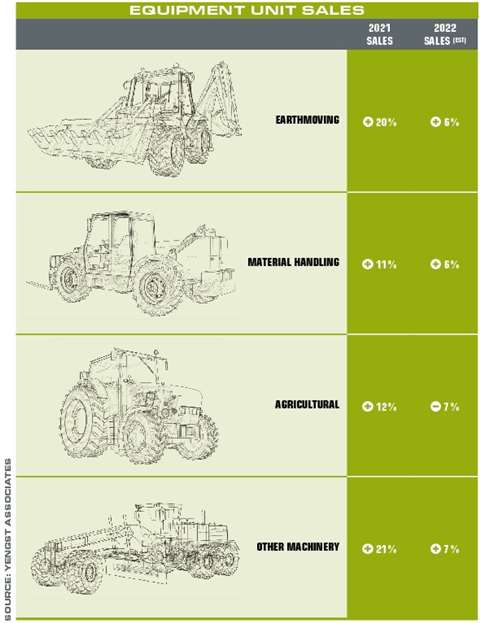

Because of the ongoing backlogs in place shooting out into next year already, this year’s demand is expected to more or less mirror sales levels of 2021. Some improvement here and there, but nothing significant.

While I am currently expecting a slight improvement over last year’s machinery sales with low- to mid-single digit growth, the landscape has once again changed dramatically when comparing this year to last. We’ve got some new headwinds these days. The country was willing to deal with what the Federal Reserve last summer deemed “transitory or temporary inflation,” but it didn’t take long before most of us realized “transitory” might mean years.

To add salt to the wound, our ongoing inflation issues were exacerbated by the Russian invasion of Ukraine, which caused a jump in both commodity and energy prices.

In recent months, some relief at the gas pump has occurred but not enough for Americans to notice in a big way. Prices have risen on goods across the board, which directly limits the amount each of us can spend each month. Wage growth has provided some relief, but it has generally been outpaced by climbing prices.

Two worlds

We began the year on a strong footing with the economy ending the fourth quarter of 2021 with about 7% GDP growth, which was extraordinary all things considered. This image of strength carried over into 2022 with the general impression being that the economy was strong. Yet, signs of weakness were beginning to surface as government stimulus relief for the pandemic was diminishing by the month. People were no longer receiving checks in the mail, PPP business loans had ceased and inflation had become part of our everyday lives.

Finishing up the first half of the year, GDP was reported to have tallied its second consecutive quarter of negative growth, which indicates the economy had been weakening and put us – by all historical measures – in recession. But how could we be in a recession when unemployment is at a very low 3.5%? Well, we’re still millions of employed people short when compared to pre-pandemic days. Some of these previously employed people were older and took part in the “Great Resignation,” you may have read about in late 2021. Others were fired and never returned, finding that government stimulus and loan forgiveness was enough to get by.

As a result, the participation rate, or the number of eligible workers working or who are looking for jobs, has crept to a 45-year low. Our current employment numbers reflect a different picture with gains of 500000-plus added in July. Yet, it appears many of those jobs were part-time or second and third jobs taken by existing workers to help compensate for the rising cost of living. So, more jobs added, just less people working.

Fed actions

The Federal Reserve, which oversees jobs and prices of goods, started raising interest rates in recent months to combat inflation. But to offset inflation, which stands today at about 8.5%, interest rates would have to exceed that level. The Fed has currently raised rates to 2.5%, meaning there is quite a long way to go.

In the meantime, both the financial and housing markets are showing clear signs of decay from their all-time valuations as increased interest rates put the cost of financing via bank loans on an exponential uptrend. Some fluctuation should be expected along the way, but because of higher financing rates, inventory of existing homes for sale are growing nationwide and price cuts are now taking hold as the pool of buyers shrinks and purchasing power decreases.

Looking ahead

What lies ahead for machinery markets depends heavily on the health and status of housing and general construction. With the coming election period in November, it is more likely than not that the powers that be will keep the economy on its best footing through the second half of the year. As we head into 2023, existing backlogged orders of construction machinery should carry on and meet end user demand into the first half of the year. Pricing is anticipated to continue to the upside – rising about 6% year over year – at the same time ongoing issues in supply chains will result in fluctuating commodity pricing.

However, as we move through 2023, further economic weakness is likely to grow with many expecting a true recession – this time with growing unemployment figures – with a downturn in the housing market through price declines and growing inventories. For this reason, we see next year starting off with a continuation of dealers filling existing orders and meeting demand for machinery, but the second half is likely to see weaker sales activity, reflected by faster backlog fills and growing equipment inventories at dealers. At the same time, some sales relief should occur throughout the year coming from government-funded contractor purchases springing from the infrastructure bill passed by Congress late last year.

About the Author: Peter T. Yengst is president of Yengst Associates, a market research and consultancy in Wilton, Conn.

About the Author: Peter T. Yengst is president of Yengst Associates, a market research and consultancy in Wilton, Conn.

I’m expecting housing starts and permits to decline further in this environment. Construction spending started the year off at its strongest pace in 10 years yet is likely to continue decreasing from its current level as well into the end of 2022. The Institute of Supply Management (ISM) reports on economic activity in the manufacturing sector, which is historically a solid indicator for the health of the industry. In July 2022, ISM figures still showed growth with a reading of 52.8. Anything over 50 indicates growth in the economy. However, this marked the third consecutive month of decline and was the lowest reading since June 2020 just after the pandemic lockdowns took place. On the bright side, it also marked 26 months of consecutive months of expansion. So, it’s been a solid run, but negative readings below 50 grow more likely from this point forward in the upcoming quarters.

To sum this all up, the coming years are less likely to outperform the previous years, which were chockful of government stimulus, low rates and pent-up demand. Another way to look at it could be that it shouldn’t be any surprise when periods of great growth and all-time highs are followed by periods of relief. To be clear, I’m not foreseeing any apocalyptic scenarios or any 2008-2009 types of crises on the horizon, and my hopes are that we emerge from this period stronger than before and reach even higher in the next phase.

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

POWER SOURCING GUIDE

The trusted reference and buyer’s guide for 83 years

The original “desktop search engine,” guiding nearly 10,000 users in more than 90 countries it is the primary reference for specifications and details on all the components that go into engine systems.

Visit Now

CONNECT WITH THE TEAM