ExxonMobil’s $59.5 billion Permian deal

11 October 2023

Company will acquire Pioneer Natural Resources

ExxonMobil will acquire Pioneer Natural Resources in a $59.5 billion deal that will more than double ExxonMobil’s holdings in the Permian Basin.

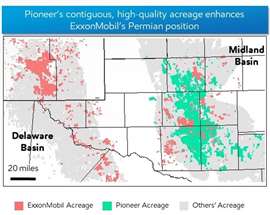

The merger combines Pioneer’s more than 850,000 net acres in the Midland Basin with ExxonMobil’s 570,000 net acres in the Delaware and Midland Basins, creating the industry’s leading high-quality undeveloped U.S. unconventional inventory position. Together, the companies will have an estimated 16 billion barrels of oil equivalent resource in the Permian. At close, ExxonMobil’s Permian production volume would more than double to 1.3 million barrels of oil equivalent per day (MOEBD), based on 2023 volumes, and is expected to increase to approximately 2 MOEBD in 2027.

ExxonMobil said the transaction represents an opportunity for even greater U.S. energy security by bringing the best technologies, operational excellence and financial capability to an important source of domestic supply, benefitting the American economy and its consumers.

“Pioneer is a clear leader in the Permian with a unique asset base and people with deep industry knowledge,” said ExxonMobil Chairman and CEO Darren Woods. “The combined capabilities of our two companies will provide long-term value creation well in excess of what either company is capable of doing on a standalone basis. Their tier-one acreage is highly contiguous, allowing for greater opportunities to deploy our technologies, delivering operating and capital efficiency as well as significantly increasing production. As importantly, as we look to combine our companies, we bring together environmental best practices that will lower our environmental footprint and plan to accelerate Pioneer’s net-zero plan from 2050 to 2035.”

Pioneer Chief Executive Officer Scott Sheffield said the combination of ExxonMobil and Pioneer creates a diversified energy company with the largest footprint of high-return wells in the Permian Basin.

“As part of a global enterprise, Pioneer, our shareholders and our employees will be better positioned for long-term success through a size and scale that spans the globe and offers diversity through product and exposure to the full energy value chain,” Sheffield said. “The consolidated company will maintain its leadership position, driving further efficiencies through the combination of our adjacent, contiguous acreage in the Midland Basin and our highly talented employee base, with the improved ability to deliver durable returns, creating tangible value for shareholders for decades to come.”

Combining Pioneer’s differentiated Permian inventory and basin knowledge with ExxonMobil’s proprietary technologies, financial resources, and industry-leading project development is expected to generate double-digit returns by recovering more resources, more efficiently and with a lower environmental impact, the companies said.

The transaction is a unique opportunity to deliver leading capital efficiency and cost performance as well as increase production by combining Pioneer’s large-scale, contiguous, high-quality undeveloped Midland acreage with ExxonMobil’s demonstrated industry-leading Permian resource development approach.

The complementary fit of Pioneer’s contiguous acreage will allow ExxonMobil to drill long laterals -- up to four miles -- which will result in fewer wells and a smaller surface footprint. The company also expects to enhance field digitalization and automation that will optimize production throughput and cost.

The combination transforms ExxonMobil’s upstream portfolio by increasing lower-cost-of-supply production, as well as short-cycle capital flexibility. The company expects a cost of supply of less than $35 per barrel from Pioneer’s assets. By 2027, short-cycle barrels will comprise more than 40% of the total upstream volumes, positioning the company to more quickly respond to demand changes and increase capture of price and volume upside.

ExxonMobil has plans to achieve net zero Scope 1 and Scope 2 greenhouse gas emissions from its Permian unconventional operations by 2030. As part of the transaction, ExxonMobil intends to leverage its Permian greenhouse gas reduction plans to accelerate Pioneer’s net zero emissions plan by 15 years, to 2035.

ExxonMobil will leverage the same aggressive strategy and apply its industry-leading new technologies for monitoring, measuring, and addressing fugitive methane to lower both companies’ methane emissions.

In addition, using combined operating capabilities and infrastructure, we expect to increase the amount of recycled water used in our Permian fracturing operations to more than 90% by 2030.

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

POWER SOURCING GUIDE

The trusted reference and buyer’s guide for 83 years

The original “desktop search engine,” guiding nearly 10,000 users in more than 90 countries it is the primary reference for specifications and details on all the components that go into engine systems.

Visit Now

CONNECT WITH THE TEAM