Dintec delivers electrified drivetrain solutions

04 September 2023

MAN utility vehicle which features a complete drivetrain supplied by Dintec

MAN utility vehicle which features a complete drivetrain supplied by Dintec

Dintec specialises in the development and installation of electrified drivetrains across various industry sectors, including off-highway machines, commercial vehicles and marine. This expertise is offered to a range of customers, including original equipment manufacturers (OEMs), systems providers and retrofitters.

The company is a satellite of the Fétis Group, a French organisation which provides electrification solutions (including automation, decarbonisation, etc.) to a broader spectrum of industries.

Michael Schmitt, Dintec

Michael Schmitt, DintecSchmitt says that up until the late 2000s much of the work completed by what would become Dintec involved development of “lighthouse projects”; demonstrators displayed at trade shows to preview the potential for machine electrification. “But then things changed,” he recalls. “Almost overnight, the lighthouse projects ended and we started getting orders to retrofit electrified drivetrains into vehicles intended to work a full service rota.”

The conversions draw on expertise from across the Fétis Group, including Dintec Ace. Based in Zaragoza, Spain, the division specialises in development and series production of wiring harnesses specified to specific projects. “We need to have capabilities like this in-house to support a quick project turnaround for the customer,” says Schmitt.

Partner cooperation

Before his current role as boss of Dintec, Schmitt was working at STW (Sensortechnik Wiedmann), a German component manufacturer supplying parts for electrified drivetrains.

Schmitt: “STW was developing their own electronic devices, invertors, DC/DC convertors, electric drives. But that’s very expensive work and the company decided not to continue. When that division became independent, we had to find new partners and one of the first companies we worked with was Visedo, which ultimately became part of Danfoss.”

“Compared to the components we were working with two, three or five years ago, the performance is spectacular” Michael Schmitt, Dintec

Yet while Danfoss and Dintec both work in the electrification space, Schmitt says they are very different companies. “Danfoss is in the component business, covering engineering, production and distribution. We do system integration, where the systems are completed using parts from Danfoss Editron and other suppliers.”

He adds that such are the broad requirements when developing drive systems the company needs at least 20 preferred suppliers to maintain a full part portfolio.

A critical element of the system integration process is getting the parts to work with each other. “All the components have different connectors, or mechanical and electrical specifications which do not always match up,” explains Schmitt. “Then there are the system considerations: functional, non-functional, safety. And then there’s the programming. Where Danfoss [Editron] supplies the components, we use those to provide a full e-system; main and auxiliary drives, charging systems.”

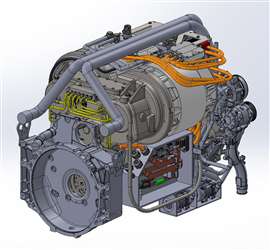

Electrified drivetrain project from Dintec

Electrified drivetrain project from Dintec

In some cases, when a project falls outside the scope of suppliers such as Danfoss Editron, those companies will pass leads on to Dintec. Schmitt points out that more than 50% of his customers are directed to the company via his suppliers.

Supplier issues

It takes a lot of background work to get the electric drivetrains up and running, explains Schmitt. “We have to know the performance of individual products, carry out testing to understand the specific hardware protocols. It helps to stay with our preferred suppliers as we know what to expect.”

That said, sometimes Dintec has no choice but to source from a different company. Schmitt remembers a customer which refused to use some brands due to aftersales considerations, in that they were only able to support rework on components from a particular supplier. This inevitably creates additional work in the testing and validation phase.

Of course, cost is also a concern, but while China-based suppliers might be expected to be less expensive, Schmitt reports that most major suppliers have similar pricing levels. “We don’t see a big price difference, no matter who we go with. If a player comes and disrupts that situation, that will be a big change. But for us, it can be difficult to work with a company in China.”

This difficulty is largely related to credit terms, where China-based companies will require full payment upfront for components which could take weeks or maybe months to arrive. That’s money which is instantly tied up in product and not making revenue. Suppliers in Europe generally offer more favourable terms, possibly requesting full payment only after the items are shipped.

Meeting demand

Component supply has been a problem for some parts, while others seem largely unaffected, as Schmitt explains: “Where the supplier has its own dedicated supply chain, they generally don’t have issues. When a supplier is relying on Tier 2 or Tier 3 companies for parts, that’s where there can be issues.”

Schematic of electrified power project

Schematic of electrified power project

He continues: “You also have to understand that we’re talking about a new market and fairly new products; plus, it’s a growth market, which is putting big demands on suppliers. We’re not talking small percentage increases, we’re looking at volumes increasing three or four fold. In the end, part supply can come down to basic allocation.”

Yet while vehicle electrification is a growth market, it still represents a very small portion of the total power market – and the supply chain is already showing signs of stress as more companies get onboard with the technology. Despite these issues, Schmitt thinks that part availability will ultimately match demand.

“In absolute terms, the number of electrified vehicles is quite small. But compared to five years ago, we have seen some exponential growth. There’s a year where we had ‘x’ number of projects; the next year we have ‘5x’. It will be up to the suppliers to keep up with this demand.”

Supply issues aside, Schmitt says that he is impressed with the improvements he has seen in part performance over recent years. “Compared to the components we were working with two, three or five years ago, the performance is spectacular – particularly in energy storage, battery power.

“It’s now required that 20% of tenders for municipal vehicles use alternative powertrains. The tech improvements will support an even greater number of applications, attract more customers. That should drive down costs and support component volumes.”

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

POWER SOURCING GUIDE

The trusted reference and buyer’s guide for 83 years

The original “desktop search engine,” guiding nearly 10,000 users in more than 90 countries it is the primary reference for specifications and details on all the components that go into engine systems.

Visit Now

CONNECT WITH THE TEAM