Agricultural equipment: Automation in the specialty crop industry

09 November 2023

Roland Berger, Western Growers Association look at the role technology will play in one of agriculture’s most labor-intensive fields

Profitability, labor availability and regulatory hurdles are the key barriers that impact specialty crop growers in the US and in Europe. (Photo: Chad Elmore)

Profitability, labor availability and regulatory hurdles are the key barriers that impact specialty crop growers in the US and in Europe. (Photo: Chad Elmore)

The agriculture industry is facing several challenges today. Those include a rapidly increasing global population, aging farmer and farm worker population, lack of labor availability, increasingly stringent regulatory environment, increasing supply chain traceability requirements, changing consumer preferences, and the effects of a changing climate.

These challenges, coupled with a volatile and unstable macroeconomic and geopolitical climate, affect production costs and crop yields for growers.

Profitability, labor availability and regulatory hurdles are the key barriers that impact specialty crop growers in the U.S. and in Europe, according to Roland Berger’s recent report on Specialty Crop Automation.

Solving these challenges requires farmers to innovate and experiment with novel technology, and automation technologies are attracting increasing interest from growers in Europe and the U.S. Technology offers the opportunity to improve the return on investment (ROI) of automation projects. Automation also helps to address the increasing lack of labor for harvesting.

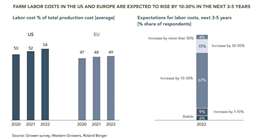

Figure 1: Grower survey results on farm labor costs. (All figures: Roland Berger)

Figure 1: Grower survey results on farm labor costs. (All figures: Roland Berger)

Indeed, 33% of growers identified labor availability as their most pressing challenge in Roland Berger’s recent analysis, while another 34% identified it as their second biggest challenge, making it behind farm profitability. Difficulty in finding adequate labor results in growers struggling to harvest all their planted crops.

This ultimately damages growers’ top line performance and, coupled with increasing labor costs, puts further pressure on profitability.

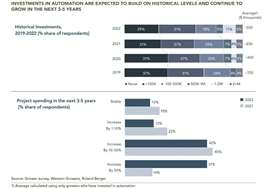

The share of grower respondents making investments in automation technologies increased from approximately 60% in 2019 to more than 70% in 2022 (see Figure 2). In 2022, the average amount spent on automation per grower reached $500,000 annually.

This showed considerable progress compared to last year, when average investments in automation were around $350,000 to $400,000 per grower per year. In addition, growers are optimistic about continuing to increase their spending on automation projects (Figure 2).

Figure 2: Grower survey results on automation investments.

Figure 2: Grower survey results on automation investments.

For example, when asked how they expected project spending to change in the next three to five years, around 40% of growers predicted an increase in spending of 10 to 50%, while around 30% of growers expected spending to increase spending by more than 50%.

The preferred business model for automation equipment usage differed between regions. U.S. growers, for example, indicated an equal preference (25% of respondents each) for contract/subscription solutions vs. the direct purchase of automation equipment. In contrast, European growers had a strong preference for direct purchase, with 75% of respondents preferring a purchase model.

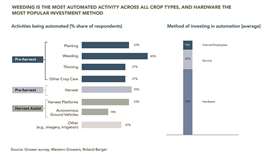

Unsurprisingly, large farms drive the bulk of investments in automation. In addition to farm size, investments in automation also varied across different pre-harvest, harvest and harvest-assist activities as shown in Figure 3.

Weeding automation technology was the most popular target for automation, with 45% of respondents investing in it. At the other end of the scale, only 18% of respondents noted investment in autonomous ground vehicles (e.g., swarm bots). These results indicate that it will be some time before fleets of autonomous swarm bots pose a significant threat to large agricultural equipment.

Figure 3: Grower survey on results on automation type.

Figure 3: Grower survey on results on automation type.

Our case studies describe in detail current applications in specialty crop automation, and their overall impact on farm profitability.

While innovation in specialty crop automation is not only driven by start-ups, the progress made new farm equipment suppliers is a telling indication of the overall health and progress of the industry.

In comparison to the previous year’s results, the start-ups that we covered in our 2022 Specialty Crop Automation report have clearly showed progress along three key metrics: maturity of funding efforts, number of paying customers, and number of robots in service.

With regards to the most recent funding round, a higher percentage of start-ups completed Series B or C financing (13% this year vs. 7% last year), while a lower percentage of start-ups completed only seed funding compared to last year (30 vs. 40%).

The same is true with respect to the number of paying customers: a higher percentage of start-ups had a high number of paying customers (32% of start-ups this year vs .13% of start-ups last year had more than 20 paying customers), while a lower percentage of start-ups had zero paying customers compared to 2021 (17 vs. 27%). Start-ups had also made clear progress with the number of robots they had in service. A higher percentage of start-ups had more than 50 robots, 11-50 robots, or even 6-10 robots than in 2021 (overall 46 vs. 23%).

Figure 4: Start-up survey results on robot activity.

Figure 4: Start-up survey results on robot activity.

These developments indicate that start-ups in the specialty crop automation space are making good progress in the commercialization of their technologies. While progress was observed across all key harvest, pre-harvest and harvest-assist activities, market traction metrics were most mature in weeding and thinning (see Figure 4).

While these results are encouraging, we believe there is still a lot of progress that needs to be made to continue to drive and scale developments. New technology adoption will require a well-educated workforce that is comfortable operating and managing more complex technology.

While existing skill gaps could be addressed through training, we believe that fostering a higher-skilled workforce would be a positive development for the industry; agriculture is becoming a high-tech job and will need to be perceived as such to attract relevant talent. For example, genetic innovation will be a critical development necessary to grow crops that are easily harvestable by robots, such as the high-rise broccoli that exists today.

Dr. Wilfried G. Aulbur

Dr. Wilfried G. Aulbur

In line with the historic transformation of broad acre farms, new production approaches and farming practices need to be put in place to facilitate harvest automation for fresh produce, such as the 2D trellis system for apples. Opportunities will exist in controlled environment agriculture, either via high-tech green houses or vertical farming, once production approaches have become profitable and more crop agnostic.

Policy updates, such as the use of autonomous robots in farming applications, can provide clarity and consistency for technological development. In contrast to the automation efforts being applied to on-highway or material handling applications, specialty crops is challenging, especially from a scaling perspective.

Giovanni Schelfi

Giovanni Schelfi

Every crop is different, environments can be uneven and rugged, and sunlight and weather play a major role.

Addressing these challenges will require access to commoditized technology components, something that the Western Growers Association is working on via its tech stack, as well as collaboration between industry stakeholders and competitors.

The road to eliminating monotonous and back-breaking work in specialty crop fields and orchards is long and hard but given the benefits, we have no doubt that technology will make a difference and enable a more sustainable and equitable future for farming.

Walt Duflock

Walt Duflock

About the authors

Dr. Wilfried G. Aulbur is senior partner and Giovanni Schelfi is partner for Roland Berger, a global strategy consultancy that regularly delivers studies about construction, agriculture and related industries for clients. Its customers are off-highway equipment manufacturers as well as engine and power generation suppliers. Walt Duflock is vice president of Innovation, Western Growers Association. The California-based group works to enhance the competitiveness and profitability of its members and support the fresh produce industry.

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

POWER SOURCING GUIDE

The trusted reference and buyer’s guide for 83 years

The original “desktop search engine,” guiding nearly 10,000 users in more than 90 countries it is the primary reference for specifications and details on all the components that go into engine systems.

Visit Now

CONNECT WITH THE TEAM