Strong pent-up demand for Class 8 to sustain orders in 2023

19 December 2022

Photo: Carloscruz Artegrafia / pexels.com

Photo: Carloscruz Artegrafia / pexels.com

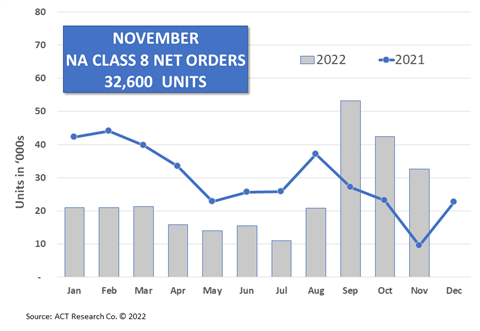

November net orders for Class 8 commercial vehicles proved robust (32.6k), bringing the three-month total to 128,000 units, said ACT Research, a leading publisher of commercial vehicle truck, trailer and bus industry data, market analysis and forecasts for the North America and China markets. The trend is expected to continue into 2023, with ACT’s North American Commercial Vehicle Outlook anticipating a surge in Class 8 orders coupled with strong pent-up demand through the end of 2022.

“Over the course of Q4 2021, there were nearly 52,000 Class 8 cancellations – orders that were booked for but not delivered in 2021 – rebooked into 2022 build slots,” noted Eric Crawford, ACT Research vice president, senior analyst. Consequently, the November State of the Industry: NA Classes 5-8 report, the monthly look at current production, sales and general state of the on-road North American commercial vehicle markets, continued to reflect strength in Class 8 order activity.

ACT’s N.A. CV Outlook takes a longer-term outlook, forecasting the next one to five years, with the objective of giving OEMs, Tier 1 and Tier 2 suppliers and investment firms information needed to plan for what’s to come. According to Kenny Vieth, ACT president and senior analyst, “In line with expectations, the industry has witnessed a surge of Class 8 orders into year end. The resulting growth in order backlogs supports higher production and gives OEMs and suppliers good visibility through [first half 2023].

“With strong demand in place and inflation metrics moderating, we are now more convinced that first half build rates will be sustained deeper into [the second half of 2023]. The more hopeful view on inflation leads us to modestly raise our 2023 Class 8 build expectations.”

ACT Research has also tempered its forecast for the severity of a decline in freight activity in 2023. “To be clear, we continue to expect a macro recession and a slight y/y decline in Class 8 build,” Vieth cautioned, “but recent economic reports and still strong Class 8 fundamentals have us thinking in a more encouraging direction.”

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

POWER SOURCING GUIDE

The trusted reference and buyer’s guide for 83 years

The original “desktop search engine,” guiding nearly 10,000 users in more than 90 countries it is the primary reference for specifications and details on all the components that go into engine systems.

Visit Now

CONNECT WITH THE TEAM