On-highway engines, vehicles on a roll despite weakening economy

01 December 2022

The N.A. Commercial Vehicle On-Highway Engine Outlook, published by ACT Research and Rhein Associates, shows the commercial vehicle (CV) industry continuing to invest in new powertrain initiatives and lower carbon emissions from CV fleets despite an unfavorable economic outlook. ACT Research’s Commercial Vehicle Dealer Digest also shows demand continuing to cushion the overall CV market in 2023.

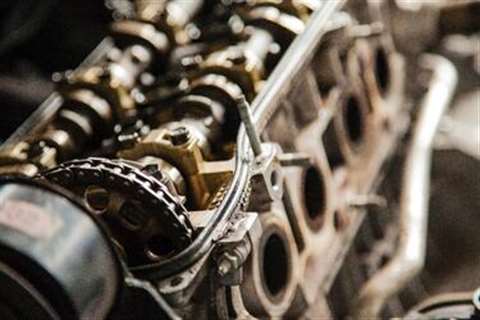

Pending EPA requirements for heavy-duty engines and trucks are behind much of the CV industry’s investment in new powertrain initiatives. (Photo: Garett Mizunaka-15709/Unsplash)

Pending EPA requirements for heavy-duty engines and trucks are behind much of the CV industry’s investment in new powertrain initiatives. (Photo: Garett Mizunaka-15709/Unsplash)

ACT Research is a publisher of commercial vehicle truck, trailer, and bus industry data, market analysis and forecasts for the North America and China markets. Rhein Associates provides North American commercial vehicle and off-highway powertrain competitive landscape intelligence. Their joint N.A. Commercial Vehicle On-Highway Engine Outlook highlights power source activity for CVs in Classes 5 to 8, including five-year forecasts of engine volumes and product trends – providing beneficial data for businesses and manufacturers in the commercial vehicle engine production supply chain and companies following the investment value of engine OEMs and their suppliers.

According to Andrew Wrobel, senior powertrain analyst at Rhein Associations, legislation is behind much of the CV industry’s investment in new powertrain initiatives. He specifically cited pending EPA requirements for heavy-duty engines and trucks.

“EPA is developing a new phase of greenhouse gas (GHG) requirements for heavy-duty (HD) engines and trucks that would apply beginning in model year 2030. This Phase 3 proposal would revise the GHG emission limits for HD vehicles while relying on the same basic certification and compliance structure already in place,” Wrobel noted. “Phase 3 is expected to include more stringent vehicle emission standards with enabled vehicle and engine emission-reduction technologies, and EPA will consider how zero-emission vehicle technologies play an important role in reducing air pollution from the HD sector.”

Kenny Vieth, ACT Research President and Senior Analyst

Kenny Vieth, ACT Research President and Senior Analyst

As a consequence, investment in new CV powertrain initiatives continues even in the weakening economic climate.

“Since March, the Fed has increased the federal funds rate by 375 basis points (bps). Monetary tightening by the Fed has pushed up borrowing costs for consumers, businesses and the government to levels not seen in more than two decades,” said Kenny Vieth, president and senior analyst, ACT Research. “Based on commentary from November’s Federal Open Market Committee (FOMC) meeting, there are more interest rate increases to come.”

The Federal Reserve is expected to continue its path of aggressively raising interest rates as long as inflation remains elevated. “Not only has the Fed telegraphed this aggressive stance, but economic data suggest the Fed has little choice,” said Vieth. “It is our view the Fed will continue on its course of tighter monetary policy as still deep-pocketed consumers and businesses drive demand for labor in structurally constrained labor markets.”

Despite such economic pressures, ACT Research has slightly raised its 2022 GDP forecast in its monthly Commercial Vehicle Dealer Digest, though analysts continue to foresee a decline ahead in 2023. The Digest combines ACT’s proprietary data analysis from a variety of industry sources to provide commercial vehicle dealer executives with a high-level industry forecast summary.

The impact of a GDP decline on the CV market in 2023 is expected to be cushioned by such mitigating factors as pent-up demand and the potential for some prebuying.

“As we have long argued, carrier profits are the critical element in vehicle demand,” Vieth stated. “Profits in 2023 are anticipated to be lower, but even modeling a sharp downturn — the worst since 2007 — truckload net margins are projected to be the fourth best on record.”

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

POWER SOURCING GUIDE

The trusted reference and buyer’s guide for 83 years

The original “desktop search engine,” guiding nearly 10,000 users in more than 90 countries it is the primary reference for specifications and details on all the components that go into engine systems.

Visit Now

CONNECT WITH THE TEAM