Future-proofing engines is ‘the right thing to do’

21 September 2022

Scott Woodruff of Rolls-Royce discusses decarbonization, the importance of incremental change and creating a forward-thinking work culture

Diesel & Gas Turbine Worldwide and Diesel Progress sat down with Scott Woodruff, vice president, Oil & Gas, Rolls-Royce Solutions America, for a wide-ranging interview that touched on the company’s journey to net zero, the future of internal combustion engines and the rise of ESG as a decision driver.

Here are some of his comments, edited for length and clarity.

Scott Woodruff, vice president, Oil & Gas, Rolls-Royce Solutions America

Scott Woodruff, vice president, Oil & Gas, Rolls-Royce Solutions America

Q: How is Rolls-Royce approaching net-zero and sustainability?

A: Rolls-Royce has really come out into the public to declare our journey to net zero. And maybe the high-level sound bite is that we have been really reworking how we approach technology… The way we’re structured, we have civil aviation, defense and Rolls-Royce Power Systems. And Rolls-Royce Power Systems has declared a 2050 target reduction of 30%. The way we look at that 30%, our upstream and production carbon footprint is not really significant compared to the carbon footprint of our product in operation.

Last year, we reorganized our business units. We partnered oil and gas with our power gen division, and created a stationary division and mobile division and also, more importantly, a sustainable division. So, sustainable is like the incubator of technologies, not only to create new business models, but to also help develop the technologies that we will use together with stationary or mobile power generation systems.

Q: Why the new structure?

A: We wanted to really continue to find ways to free up the mindset of our employees to be creative, to think of new ideas. And what we’ve been hard at work on in the oil and gas side is not only optimizing the technology that we’ve already brought to market, but taking advantage of the technologies already in development for stationary power generation, or even our mobile businesses, and essentially making some of that technology mobile, mobile ready or even more mobile.

Q: Talk about the decision to not embrace bi-fuels.

A: We decided, really, a few years ago that we weren’t going to follow this bi-fuel trend in the oil and gas markets. So we decided actively not to follow that and that we wanted to optimize our diesel solution and our 100% gas solution.

It started as a realization that we have used that type of technology in the marine side, and at that time, our CTO was from the Daimler ecosystem and had biofuels experience from on-highway. The on-highway side has a cycle of evolution that is much faster than it is in the off-highway markets and you can learn a lot from that.

So, we decided against bi-fuels and wanted to really hunker down and say, “Look, we need to be focusing on not only costs of operation of the engine from a fuel consumption standpoint, but how can we make the operation of our power generation solutions more people efficient, more movable? How can you use less equipment to move it down the road and have fewer people to run it?”

And so what we’ve been doing is really maturing the technology and offering customers a couple of different options that are optimized: optimized diesel and optimized natural gas. The bi-fuel technology is not optimized for diesel or gas. And we realized that technically — and give our R&D team credit for this — that methane was going to become the enemy even more than CO2 from a greenhouse gas standpoint. And we knew that bi-fuel technology so far — wherever we saw it, and in our own technology that we had developed but didn’t launch — was actually going in the wrong direction and that we were in a position to pivot.

So essentially, it started with a technical enunciation like this is wrong, we shouldn’t do this, to us saying, “Okay, that’s the inspiration, what do we do differently?” And that’s where we step up and say that we have another technology here that doesn’t have that issue that is even more efficient. And we believe electrification, like it did in mining, is going to bring more efficiency to the upstream onshore business.

So, you’ll see a lot more from us about really creating the culture of thinking ahead — what can we be doing to constantly be moving towards the net-zero target? I mean, it’s everything from really embracing how long an operator is running an engine, how much idle; are they really running it in the right sort of zones, and what can we do about it; how do we get a better relationship with them to be able to coach them on how to make that engine more efficient. That’ll certainly be dependent on the appetite of the oil companies and the operators getting serious about reducing their carbon footprint, which has happened.

Q: There’s a bit of a push-pull in this? Companies aren’t looking necessarily for the cheapest solution?

A: They went from “follow the money” to now still “follow the money, but what will become the problem financially?” While we all want net zero and a cleaner environment, this is really being driven by ESG scores on the corporate level. If I’m ExxonMobil, Chevron, and I have the ESG score that is not investor friendly, I can’t raise capital. And so, we saw that evolving and said, “Okay, I mean, isn’t this great? I mean, it’s right in line with our technical culture.” We tend to get ahead of ourselves in technology.

Q: So, you’re seeing companies looking at ESG (environmental, social, governance) to drive some of these decisions?

A: It’s kind of funny, the conversation is more like: “We want to spend money. What do we do?” They’re looking to us, which is great. I mean, this is the way it should work. It’s almost a really healthy thing. I would say that most of the conversations are us giving ideas and solutions that we could do or are already doing, and then trying to figure out where the company is at, what do they want to do and what’s the timing?

You might think that it’s mostly a North America, phenomenon, but… we met with an Indian oil company and you can see their body language — they’re very motivated to do something. A couple months ago, I was with Aramco and ADNOC — very motivated. Like, that’s all they could talk about. All these leaders know that their boards have made commitments publicly and now they’ve got to start figuring out how to do it.

What we’re trying to do is say, “Look, this is not an on/off switch, we have to figure out ways to work up to net zero.” I mean, 10% fuel savings tomorrow is a huge CO2 savings over 10 years. And we’re just trying to now expose oil companies, mining operators to these things that we’ve known that maybe operators have lost sight of. They were focused on fuel consumption, and that’s still the right thing to do, but now we have to figure out how do we get to the next layer of efficiency? There’s so much low-hanging fruit in the oil & gas market right now.

Q: There’s interest in decarbonization even in the oil & gas segment?

A: And this is a totally different conversation than we’ve been having. If you could go back five years in a time machine, you would never expect an oil & gas company to have that conversation.

Q: So, there’s a lot of low-hanging fruit?

A: All the industries on this side just idling way too much and that’s a waste. I would say digital is enabling us to mitigate that. We’re still mechanically contemplating what’s that’s going to do to the engine like the car guys did. Idle management in cars was exciting and a new thing — now it’s just normal. You just don’t think about it anymore. It’s really impressive how the auto industry has done that. That’s the same thing that we want to do.

[What we] have been trying to do in this industry is to figure out how to use energy storage, monitoring electronics, to now optimize, to synchronize, so if I’m Schlumberger and I have a couple of 100 frac trailers or drill engines, and now suddenly I reduce idle by 5% or 10% on each, that’s an improvement. I think that, to me, is something that’s not talked about enough. In my opinion, none of these companies that have these targets are going to get anywhere near it unless they optimize what’s already there. I’ve thought about this a lot and I don’t see how it’s possible in the industries I’m familiar with.

The mtu EnergyPack is a key component for improving the reliability and profitability of microgrids and energy systems. It stores electricity from any distributed power source – such as gen-sets, wind turbines or solar panels – and delivers it when needed. The mtu EnergyPack is available in three sizes: QS, QM, and QL, from 60 kVA to 2000 kVA, and from 70 kWh to 2200 kWh. (Photo: Rolls-Royce Solutions)

The mtu EnergyPack is a key component for improving the reliability and profitability of microgrids and energy systems. It stores electricity from any distributed power source – such as gen-sets, wind turbines or solar panels – and delivers it when needed. The mtu EnergyPack is available in three sizes: QS, QM, and QL, from 60 kVA to 2000 kVA, and from 70 kWh to 2200 kWh. (Photo: Rolls-Royce Solutions)

That’s why we want to be focused on what was, not just what’s coming. That’s something that we did in mining, where repower is where you take an older engine, [retrofit it] with a newer one, now that truck has a new life. I think in the fracking side, for instance, we have that opportunity and in drilling for sure.

Q: What do you see on the horizon for regulations?

A: Honestly, we all thought in the beginning that emissions would be regulated by governments. It’s going to be totally regulated by the stock market; the EPA in this industry is not going to have much to do. Because as long as that ESG score is not where the investors want it… That’s the motivation. It’s not that they don’t want to get fined or any of that. But I think that’s going to be the real global standard.

What we bet on with this technology is to make it global even though it was developed for the US and Canada originally; that was just the starting point. Now what we’ve got is technology that can be used in Dubai, Saudi Arabia, India, Chile. Our biggest Tier 4 fleet is in Chile, not the United States, because that’s copper and that’s where they have the money and they pushed it. And Anglo is a very progressive global mining company. They said “we want to reduce our carbon footprint” and they started early.

I think the big surprise for a lot of people is assuming it’s going to start in the EU and the United States. It didn’t. I would say even Australia is a bit behind right now. They talk a good game, but they really haven’t started pushing. I’m not criticizing them, but in the off-highway space, they’ve been behind on that zero-carbon path.

Q: Your customers, they’re seeing a lot of different technologies being promoted. If you’re going with something that’s not particularly new, are they asking what about hydrogen or ammonia? What about these other technologies?

A: I always refer to it as a ramp getting on the highway — you’ve got to accelerate to get to the highway.

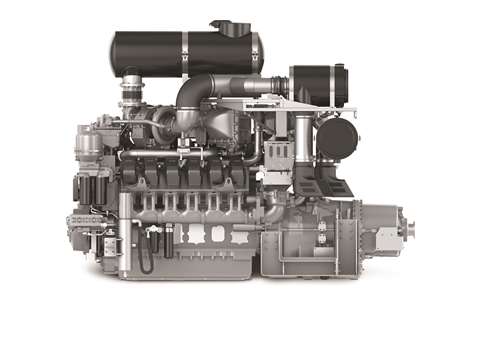

[We have a] 20-cylinder natural gas engine that already can run 10% hydrogen. It’s net-zero ready or sustainable ready. It’s not totally sustainable, but it’s taking a step closer. The next step for this engine is we will have a retrofit kit that will take you to 30% hydrogen. We’re trying to time that to when you can actually get 25% to 30% of green hydrogen delivered. That’s the debate.

Q: I think the hydrogen technology is a little bit farther ahead of the supply of hydrogen.

A: We know how to develop a 100% hydrogen recip engine. But to spend that money right now would be a waste. It would be great if somebody came along and said, “We’re going to give you $100 million to develop that engine.” But you couldn’t burn hydrogen in it because you can’t get [hydrogen].

Q: Looking back five to 10 years ago, there was some debate whether internal combustion engines could survive in a march to zero carbon.

A: We’ve already done testing, and so have our competitors, on renewable biofuels and are already getting great results, like reduced fuel consumption and emissions, like, measured emissions, according to EPA.

When you start making the transition from recycled biofuel, or recycled biodiesel, to fuels that are infused with green hydrogen — that are taking carbon out of the atmosphere, even if it’s not 100% — it’s still stepping in the right direction. Then you could have this technology that’s already optimized for efficiency, wanting those net-zero fuels or partially net-zero fuels. And the infrastructure is there to transport it. The technical know-how is there to rebuild it or repair it. We’re not talking about space-age technology that nobody knows how to work on, which is the problem with some other technologies.

Scott Woodruff, vice president Oil & Gas at Rolls-Royce Solutions America, says incremental improvements in fuel economy make a big difference in cutting emissions. (Photo: Rolls-Royce Solutions)

Scott Woodruff, vice president Oil & Gas at Rolls-Royce Solutions America, says incremental improvements in fuel economy make a big difference in cutting emissions. (Photo: Rolls-Royce Solutions)

While we’re still working on the fuel cell — we have one running right now in our demonstrator in Germany — we’re still working on the single-cylinder, 100% hydrogen engine or a version of this engine. We took a chance on this technology 25 years ago, and it’s paying off. Because now this engine has come along so far that once you start putting HVO and e-fuels in it, it takes us quite a long way. This engine has 43% to 44% thermal efficiency, which is phenomenal. And what we’re seeing in biofuel is in the mid-30s, to low-30s. I mean, almost 10% difference. When you multiply it by a fleet of 50 to 60 frac trailers, it’s a big deal over a year or five years.

So, say it was easy to do a hydrogen version decision tomorrow. Is it really net zero to take all those older engines out and throw them in a landfill or melt them down and replace them all? Because you’re generating more carbon if you do that. We like this idea of being able to use the existing footprint installed base and make it cleaner with incremental retrofits.

Q: A lot of engine manufacturers like to talk about future-proofing the fleet.

A: That’s the idea. A few years ago, when the market was really bad, I was really contemplating that the decision to stick with the technology was a mistake, because I fought very hard to keep this technology going. Now, I’m convinced it was the right thing to do. And now we’re starting to get more experience running the engines, getting more data sets, we’ve made some stabilization design changes that worked.

The frontier for us right now is to get better at on-condition maintenance, in really extending the useful life of all the components. Where is the slope change between too much risk —stretching out a part too long, destroying the engine and starting over — versus getting the right amount of life out of it so that you’re not wasting parts. Like the on-highway market — they don’t take a whole metal oil filter off, they have a canister inside and they reuse the outside.

Q: Any big surprises in the journey so far?

A: I would say the biggest surprise to me is operators are just so far away from really running the engines efficiently. And we can see, with maybe more statistical significance, that there’s a lot more efficiency, right there now, that’s not being utilized. I mean, there’s some things that we’re kind of bitter about, like even torque transmission, or how much of the torque the fuel creates in the engine is actually transmitted to the driveline. For us, that’s energy going in that could be used that isn’t being used.

There’s also more interest in the oil & gas space on helping us manage their maintenance than I expected. There’s more openness on really logging data. We always heard when we first started this journey that the oil & gas operators will never let us log data or do anything. I don’t hear that anymore. The phenomenon of the Great Resignation sort of started in the oil & gas industry — not because of Covid but because of the market cycles, people got tired of it. Now these companies have got to figure out how to do the same amount of work, or more, with fewer resources, especially people.

What it means is that they have to figure out, and are figuring out, how to be more autonomous. Blenders now don’t have [someone] sitting there… running the blender, they can run them remotely. We have a case — I won’t name the customer yet because they’re still working on this — they’ve been able to reduce the number of people at a frack site by at least 50%. And what we’ve heard — and we can’t prove it, just a rumor — is that by the time an oil company pays for a [worker] on the frack site… it’s about a million bucks a year.

It sounds counterintuitive because you want to create jobs. But there’s nobody to fill those jobs anyway, so you have to figure out how to make it work with less people.

Q: How do you balance the challenge between selling units and making them last longer?

A: It’s a leap of faith to say we want to make an engine that is the most maintenance friendly possible. But that means, theoretically, we sell fewer parts over the long haul.

There was some short-term pushback, but in the end, we said, “No, this is the right thing to do.” And it checks all the boxes:

- The customer’s happy because it’s cheaper.

- There’s less waste from an environmental standpoint.

- There should be a safer operation because you’re touching it less. The more you have a person interacting with a hot engine, the less likely you are to have an injury.

And so it kind of just kept making sense. We were pushed and pulled that way in the mining industry and what we did is make a really loud voice in the company to say: “Oil & gas is actually going through the same evolution that mining already has. Why can’t we learn from what we did there? And not to mention, learn from what we’re already doing in power generation, and take solutions that we have already and adapt them to oil & gas and not start over?”

But I think what we weren’t doing enough of is really being agile with technologies like the energy storage systems that you use for stationary microgrids. Now what we’ve done is adapted the design to make it movable, which had not yet [been done with] a large battery storage. They drive around in cars, but not as a power source that can be moved.

I would say we’re still learning, we’re still pushing, and there seems to be a lot of interest, serious interest. That also checks the box in that we’re making the power more efficient, with fewer engines [that] can run in a more efficient point in their load curve. And now you have this reserve power that you can use only when needed, but it’s not sitting there generating CO2.

It seems like the industry is catching fire. The conversations we have are productive. Whereas before it was kind of a lot of selling, a lot of convincing, now it’s more getting into “How much CO2 can we save?”

Q: What are some of the challenges?

A: We made the business case on engine health monitoring by saying if we can save one engine per year from a catastrophic failure, that’s all we need to say. It becomes obvious when you can say to an operator, a Halliburton or a Schlumberger, “With this monitoring, we can save you one catastrophic failure a year.” That’s enough.

Now we’re trying to figure out in all cases and all these different operating environments, what does it have to be to know that a failure is going to happen? Unfortunately, in this big machinery, you can go from “sounds great,” to brought out the block in 10 seconds. The engines actually absorb a lot of sins, more than we realize, now that they’ve run for quite a while. And that’s been one of our challenges.

Maybe we did too good of a job of creating a buffer, and now trying to figure out where do we make a decision to say, “Hey, shut it down. In three hours, you’re going to have a catastrophic failure.” We can’t do that now. We’re getting better… we can say, “Maybe in a week, you’ll have something go wrong.” But we don’t know.

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

POWER SOURCING GUIDE

The trusted reference and buyer’s guide for 83 years

The original “desktop search engine,” guiding nearly 10,000 users in more than 90 countries it is the primary reference for specifications and details on all the components that go into engine systems.

Visit Now

CONNECT WITH THE TEAM