Forecast 2023: Gen-set production mixed in ‘23

05 October 2022

After a solid first half, several factors could bring a softening of demand

This forecast originally appeared in the September 2022 issue of Diesel Progress.

As we consider the overall power generation industry in 2022, we have finally started to see improvement in the supply chain and some dealers finally getting long-awaited inventories to help fulfill orders. Demand overall remains strong and the easing of the supply chain over the course of 2022 has helped. There is still progress to be made in the supply chain, but things look much better than one year ago.

The most common questions being asked these days involves recession: “Are we in a recession?” and “How do we define a recession?” The federal government has a business cycle dating committee that tracks month-to-month statistics to determine when a recession officially begins. We have recently seen several months of slowing and negative GDP growth.

However, we are in a unique situation in that compared to previous economic cycles that might signal recession, unemployment levels remain at historic lows. We would normally expect to see unemployment rise as businesses pull back going into what they feel is a recessionary economy.

Nonetheless, whether we anticipate a recession officially or not, we’re coming off two strong years following COVID and satisfying pent-up demand while struggling through ongoing supply chain issues.

In terms of total North American generator set production, we have been going at a good clip for two years now. Economic cycles are inevitable and probably the strongest indicator affecting the gen-set market is interest rates. We will take a deeper look at those shortly, but all signals point toward a pullback as we head into 2023.

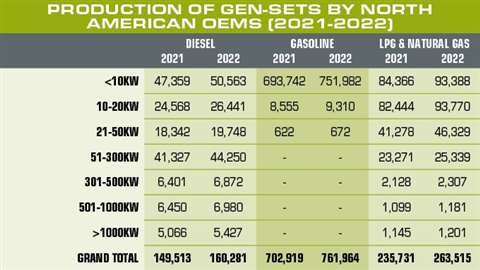

Source: Power Systems Research

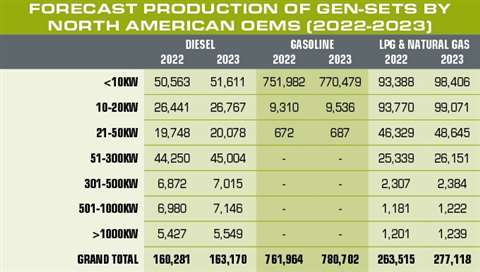

Source: Power Systems Research

When we consider all power ranges of North American gen-set production, we have a total market in the range of 1 million units per year, considering all fuels and power ranges. Let’s look at some key barometers that identify prospects for the North American power generation market over the next year.

Key barometers

Interest rates rising to curb inflation: In the July meeting of the Federal Reserve Open Market Committee (FOMC), the target for the Federal Funds Rate (FFR) was increased by 75 basis points. This marked the fourth consecutive FOMC increase of 2022 in continued efforts to tamp down inflation. The Federal Reserve has continued its effort to help offset the highest rate of inflation in the U.S. in nearly 40 years.

As interest rates climb, we see several downstream effects on gen-set demand. The first is that the rate of financing gen-sets for projects in the commercial sector becomes less attractive for businesses looking to upgrade or install a new unit. The consumer/residential sector is also feeling the effects. Many home standby units are financed through home equity Lines of Credit (HELOCs) or other loans, and the cost of those funds becomes more prohibitive as interest rates rise.

Housing starts cooling off: When comparing the average annualized rate over the course of each year, housing starts were strong to begin with in 2021, up 16% in 2021 versus 2020. Starts of new privately-owned housing units are continuing into the current year with annualized levels for June 2022 falling behind those for June 2021 by 6.3%.

Even though the new housing starts are cooling off, we are still at historically high levels. But increased interest rates are slowing the number of new starts each month in 2022.

The markets for housing are probably the best barometer for the health of the smaller gen-set markets (under 500 kW), as there are many demand drivers connected between new home construction and the need for gen-sets.

New considerations

The infrastructure bill: In August 2021, the U.S. Senate passed the bipartisan infrastructure bill that will direct $550 billion in new federal investments in America’s infrastructure over a five-year period. The bill was officially signed into law in November 2021, and we are now starting to see a number of larger scale projects move forward as funding is directed toward several key areas. These projects will have far-reaching and positive implications for power generation, especially for gen-sets used for mobile power in rental and those procured by construction companies.

Projects under the bipartisan infrastructure bill will have far-reaching and positive implications for power generation, especially for gen-sets used for mobile power in rental and those procured by construction companies. Shown is the Taylor TR170 gen-sets supplied by FTG.

Projects under the bipartisan infrastructure bill will have far-reaching and positive implications for power generation, especially for gen-sets used for mobile power in rental and those procured by construction companies. Shown is the Taylor TR170 gen-sets supplied by FTG.

Reduced residential demand: The last two and a half years have been a near perfect storm for residential gen-set consumers. Demand significantly increased in the wake of COVID-19 with people spending more time working or learning from home. But this situation is likely to change.

The perfect storm affecting the market has seen demand significantly increase for smaller LPG and natural gas gen-sets as well as gasoline portable units, while at the same time, supply chain disruptions and lack of dealer inventory has put an upward limit on growth. In addition, higher inflation combined with increased costs of borrowed funds from sources such as HELOCs has caused softening in the residential markets that will continue as we head into 2023.

Supply chain disruptions: Last year, we reported on severe supply chain constraints limiting production as critical parts needed to complete finished gen-sets were simply not available. The good news is that the situation seems to be improving over the course of 2022, although some dealers are still faced with longer than normal lead times.

In our PowerTracker syndicated survey, we speak with 200 gen-set dealers each quarter. The survey showed that the second quarter of 2022 was the first quarter where dealers reported an increase in inventories (up 6.6%) relative to inventory levels in the first quarter of 2022. This is the first reported quarterly inventory increase since the first quarter of 2020. Dealers endured eight consecutive quarters of negative quarterly inventory change. Needless to say, inventories are depleted, and the next year will be spent building inventories back up to acceptable levels that balance lead times and expected demand.

Even if demand falls off due to softening market conditions, production by gen-set OEMs during the remainder of 2022 and into 2023 will still be challenged to replenish inventories to dealers.

The weather

The single most important factor that drives annual gen-set volumes is weather. Global climate change is a potentially contentious topic, but there is evidence that a larger number of weather events, such as flooding, ice storms, hurricanes, tornados and wildfires, have been impacting the U.S. in recent years. A common element in all these unfortunate situations is a need for temporary/remote power that will drive a surge in demand.

FEMA as well as retailers have factored the possibility of these weather events happening in any given year. Inventory levels are planned in advance to absorb some surge in demand, but as these events unfold year-to-year, they do factor into the annual production of gen-sets.

Source: Power Systems Research

Source: Power Systems Research

Outlook for 2023

Looking forward to 2023, it is important to first review 2022 production levels for context. Overall, at Power Systems Research, we are expecting production levels in 2022 to reflect healthy gains over 2021 production as assembly operations are less hampered by supply chain constraints. In 2022, we expect production of diesel-fueled gen-sets to end the year up 7.2% over 2021, with gasoline up 8.4% and finally LPG & Natural Gas-fueled units up 11.8% over 2021 levels.

Looking at 2023, we expect a few factors to influence production of gen-sets. On the one side, there will be carryover in demand to fulfill orders already placed in 2022, which will keep production flowing soundly into the first half of 2023. A second factor is a softening of overall demand primarily due to increased interest rates and inflationary effects on purchase decisions.

Overall, these factors will soften demand. Keep in mind, we are already at historically high levels of production, so a small positive increase is still reflecting a high level. But the softening of demand will limit the peak of production for 2023. As we move further into 2023, we will be able to better evaluate the final outlook for 2023 and what that might mean for 2024.

About the author: Joe Zirnhelt is president and CEO at Power Systems Research, an information and research supplier based in St. Paul, Minnesota, with offices in Detroit, Brussels, Tokyo, Pune and Sao Paulo.

About the author: Joe Zirnhelt is president and CEO at Power Systems Research, an information and research supplier based in St. Paul, Minnesota, with offices in Detroit, Brussels, Tokyo, Pune and Sao Paulo.

In 2023, we expect the highest gains in production for the LPG and natural gas units driven largely by fulfilling increased demand from residential consumers and small commercial applications in the under-50 kW ranges. Overall, LPG and natural gas gen-set production is expected to increase 5.2% from 2022 to 2023.

Gasoline units are already at historically high levels. In pre-COVID times and before the latest surge in new home construction, production of small gasoline portables in North America was around 630000 units per year. In 2022, production of gasoline gen-sets is estimated to end up around 761000 units. Gasoline gen-sets have seen healthy growth the last several years, and as the demand softens in 2023 there will be noticeable pullback on demand for these units. We estimate a growth rate in production from 2022 to 2023 of 2.5%.

Finally, in diesel-fueled units there will be modest growth of 1.6% overall from 2022 to 2023. It will be slightly stronger in the power ranges above 300 kW where there is less price sensitivity and the gen-sets are most often pre-budgeted and planned more in advance and somewhat more insulated from inflationary/ interest rate effects.

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

POWER SOURCING GUIDE

The trusted reference and buyer’s guide for 83 years

The original “desktop search engine,” guiding nearly 10,000 users in more than 90 countries it is the primary reference for specifications and details on all the components that go into engine systems.

Visit Now

CONNECT WITH THE TEAM