Skyjack president discusses new facilities in China

01 April 2022

As Skyjack continues with the development of a new manufacturing facility in China, Ken McDougall, Skyjack’s president speaks exclusively with AI about the ongoing project.

Ken McDougall, president of Skyjack

Ken McDougall, president of Skyjack

Skyjack has been weighing up its options in Asia for some time, with a view to finding the right manufacturing base.

It has made no secret that using the existing facilities of parent company Linamar would make sense. That is exactly what Skyjack is now doing, as well as laying out plans for a major new plant of its own.

Initially, Skyjack will adapt facilities at Linamar Corporation’s Tianjin plant, with the focus being on its compact scissor lift line. This will be followed by the new plant, of around 50,000 square metres, in the same industrial zone as the Linamar base.

Linamar entered the China market in 2005 and has five facilities and one research and development centre. Skyjack is set to begin manufacturing in those facilities in the first quarter of 2023.

To start with manufacturing will cover 15ft and 19ft scissor units, with a move into telescopic and articulating boom lifts in the pipeline, although the exact details of those have not been confirmed.

As Ken McDougall, president of Skyjack, explains, “We’ve been studying the Chinese market, as everybody has for decades, and we’re now utilizing the existing Linamar facility where we will set up our first product line to give us a little bit more speed to market.”

Meanwhile the plans for the standalone Skyjack factory in the same industrial park, where it has secured land rights, are progressing. “We’re going through all of the regulatory approvals and building drawings.

“It depends on construction timing, but our goal at the moment is to have that up and running or available for occupancy before the end of next year as well.” Specifically that third quarter 2023.

Regional manufacturing strategy

While it may appear that the company is coming late to the Chinese market, McDougall has been planning its approach to Asia and the global market since his return to Skyjack in 2019.

This is McDougall’s second stint as president of Skyjack. He joined the company for the first time in the early 2000’s as vice president of operations, before taking over the presidency from 2004-2009. He then moved back to his automotive routes at Linamar.

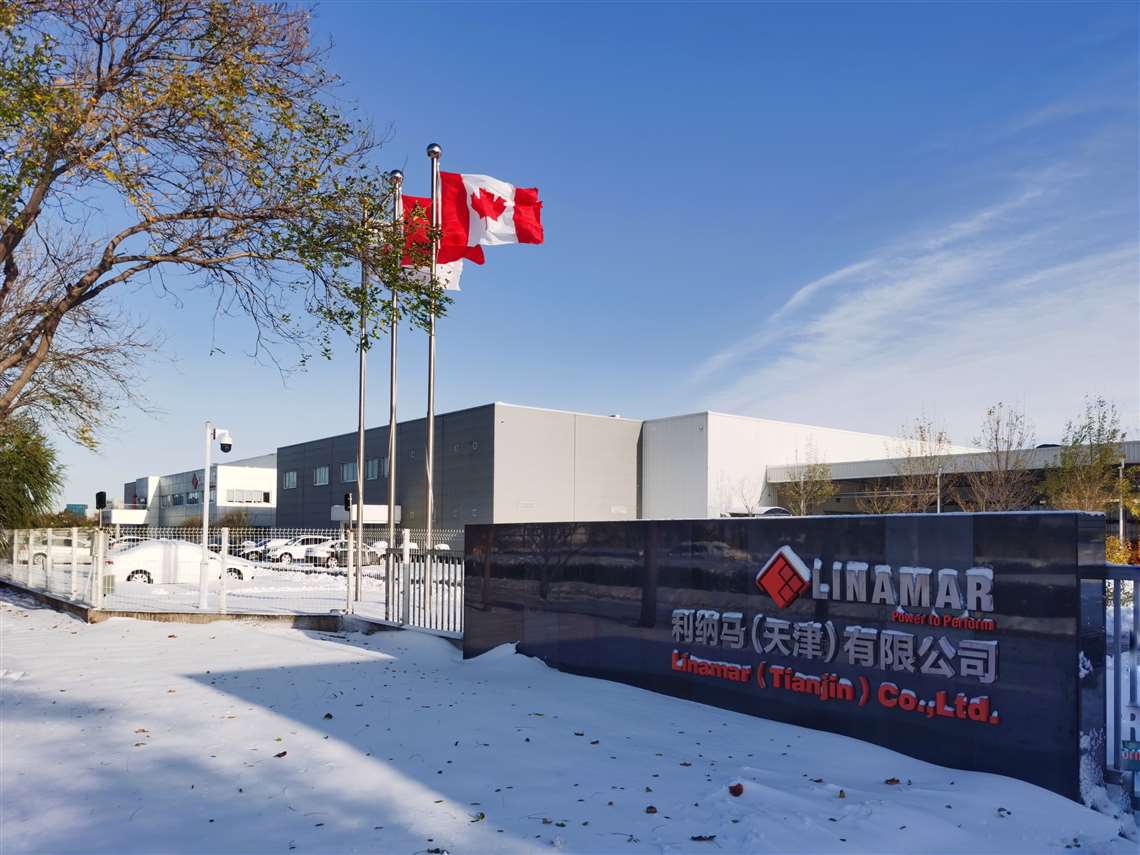

Skyjack will operate from the Linamar base until the new facility is finished.

Skyjack will operate from the Linamar base until the new facility is finished.

The plan will see the company separate its manufacturing footprint into three regions.

These are the Americas, with its main Canadian headquarters’ manufacturing plant; Europe, which primarily offers sales, service and distribution, with a limited amount of manufacturing at Linamar’s facility in Hungary; and Asia Pacific, with its new facilities in China which will become a central hub for Skyjacks’ entire Asia Pacific operations.

One of the positive outcomes of Skyjack’s new manufacturing plan will be an improved product flow.

“We will still have some cross shipping and supply between regions, but to try to cut down on logistics and duties, which has really been highlighted through the pandemic.”

The move into China is also designed to provide considerable scope for expansion in the market, which currently accounts for less than 1% of Skyjacks’ total global sales.

Putting that into the context of Skyjack’s global sales map, the company’s home market of North America provides 60% to 75% of sales volume.

Beyond that core market, Europe takes much of the balance, while the Asia Pacific is a relatively small market overall, with the exception being Australia, which is approaching 3% of global sales.

Traditionally, Asia has been managed from a senior level in the UK with support directly in the Asia region. However, there is now a view that direct management will be an advantage.

“We’d like to see that enhanced by having a closer to time zone focus on the market, and we can see that this would allow us a more focused approach inside the whole region.”

Establishing a business division in China

Leading Skyjack’s operations in China will be another longstanding Linamar employee Chan Tran, as the company’s vice president of the Asian Pacific region.

“I’m coming up to my 35th year at Linamar and I’ve worked with Chan probably for over 20 years on and off,” says McDougall.

“A good chunk of his career was in Canada, then he relocated over to China to run parts of the operation there. We were lucky to be able to get him. He understands the language, he’s immersed in the culture and he’s a good business head for us.”

A team is now being created around Tran, and already includes a couple of sales representatives and test engineers.

McDougall says, “With the pandemic, we have a minimal number of expats we’re sending, hopefully that will open up and we’ll then have more ability to send people onsite.”

Due to the spread of Covid and the toughening restrictions in China, the negotiations for the plant have not been as straightforward as hoped.

It meant that the signing ceremony between Skyjack and the local government had to take place virtually.

“I was sitting in a hotel in London early in the morning doing a virtual signing ceremony,” says McDougall. “So, we’re excited to get it going and have Chan on board – it’s a real blessing to have that opportunity.”

Expanding manufacturing operations in China

Expanding on the Tianjin factory McDougall explains, “What we would see over time is that facility build up to fully functioning production of scissors and booms.

“And, depending on what happens with the telehandler market, development could also be in that area too.”

“We’ve made enough provision to produce that in a very large facility, to cover all of those products”.

He adds, “Ultimately, we see that facility being a distribution centre to supply the other Asia regions from there as opposed to the transportation costs and the capacity constraints of shipping from Canada.”

The plan to first introduce the compact line to Tianjin was two-fold; firstly, there is limited floorspace available in the current Linamar factory, and secondly, “It is a very crowded market over there and all of the [China] national companies are kind of in that smaller scissor market range.”

The challenges of manufacturing in China

One thing is for sure, the competition in China is as keen as anywhere in the world, with its mix of relatively new and longer established domestic OEMs, along with the manufacturers based in Europe and North America.

Commenting on the raft of new Chinese manufacturers, McDougall says, “There’s a whole bunch of competition - some of that may sort itself out because there’s so many. I think some of them may go or be consolidated.”

Focusing on the challenges found in China, there are a few; one of them being, “the massive number of competitors that are in the market.

“And one of the other challenges,” adds McDougall, “Is equipment financing, which is not readily available.

Linamar Corporation’s Tianjin plant

Linamar Corporation’s Tianjin plant

“We’ve heard the horror stories of some of the regional players and other international players that have gone in, made some trade deals and then they’ve been burnt on being able to collect. So, we’re fairly conservative - we’d like to get paid.

“There’s been a lot of financing companies that have been in and out of the market. That is also something that’s a little different than other parts of the world.

“And the rental chain isn’t as established and some of [the rental companies that are], are partially owned or have been assumed by some of the other national OEMs.”

An advantage that Skyjack does have is a good understanding of Chinese culture. “We just need to make sure that we’re not a North American company in China.

“We need to become a Chinese company that has a north American partner, because what we may want here, in terms of design and everything else, may not fit that market.”

This philosophy may also stretch to manufacturing. While duplicating assembly lines around the world and shipping locally makes sense overall, it may not be right for all models.

“We would look at each model. We would look at basic return on investment. With certain models, it may not make sense to set up them up everywhere.

“So, you might have a bit of a mix between both, but yes, it would be the primary objective that that facility would serve the Asia Pacific market.”

Potential market growth for access equipment

With the large capacity expansion in China, there are no plans to reduce production elsewhere. In fact, the opposite is true. As McDougall says, the company, “needs more capacity”.

Besides the well documented supply chain issues, as a result of the pandemic, that has led to pent-up demand for equipment, McDougall believes there is more room in the market for general growth, particularly for Skyjack.

“We need more space because we’re kind of capped out. If you go back a couple years, just prior to the pandemic, it was probably our biggest year. It would be a stretch for us to get much more than that without adding capacity.

“We’re not sitting back being satisfied with the level that we have, and the goal that I have is to add that capacity globally, so that we can make products in the market for the market and free up capacity in North America.”

Not only are there plan to fill that spare capacity at the Canadian factory but there are also plans to expand manufacturing in North America.

McDougall won’t be drawn on where that extra capacity would be situated, except that it will be, “somewhere in North America.”

As these plans would suggest, there are also no plans to reduce the workforce in any of the company’s locations.

“We don’t see us reducing our staffing levels. We do see that with the supply chain challenges, you could probably see us integrating more vertically some of the things that we put out,” says McDougall.

“But we’re still looking for, and we’ll continue to look for more staff in Canada and will continue to look in other parts of the world to bolster capacities in America, Europe and Asia.”

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

POWER SOURCING GUIDE

The trusted reference and buyer’s guide for 83 years

The original “desktop search engine,” guiding nearly 10,000 users in more than 90 countries it is the primary reference for specifications and details on all the components that go into engine systems.

Visit Now

CONNECT WITH THE TEAM