Rolling Past The Pandemic

22 January 2021

Trucking industry continues to see high demand for freight, vehicles, drivers.

By Kenny Vieth

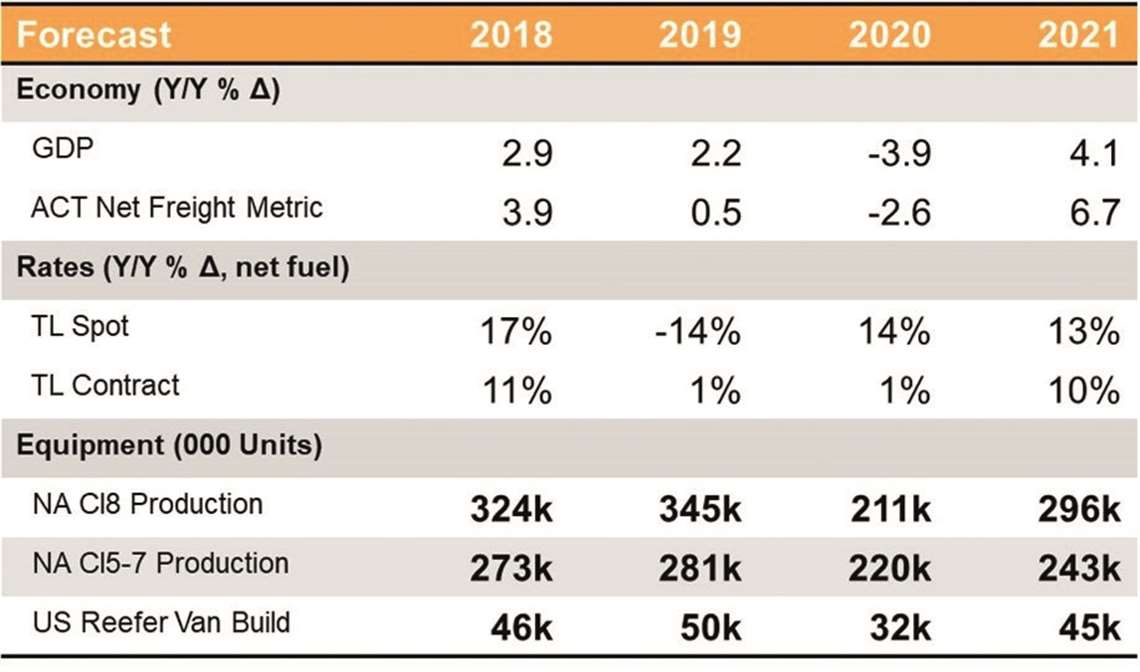

It has been said that if you have to forecast, forecast often. ACT’s contribution to the Diesel Progress Forecast 2021 issue last September occurred at the front of a freight rate and volume surge that began in mid-summer and has not abated since. To that end, expectations for 2021 have risen materially. This is occurring despite the COVID-19 pandemic that is keeping some parts of the service economy struggling and amid record rates of infection and death.

To provide better guidance, we are taking a second bite at the North American commercial vehicle forecasting apple for Diesel Progress readers.

Whether we are looking at the moderately cyclical medium-duty Classes 4-7 truck market or the deeply cyclical heavy-duty Class 8 market, there is a strong correlation between carrier profitability and new equipment demand.

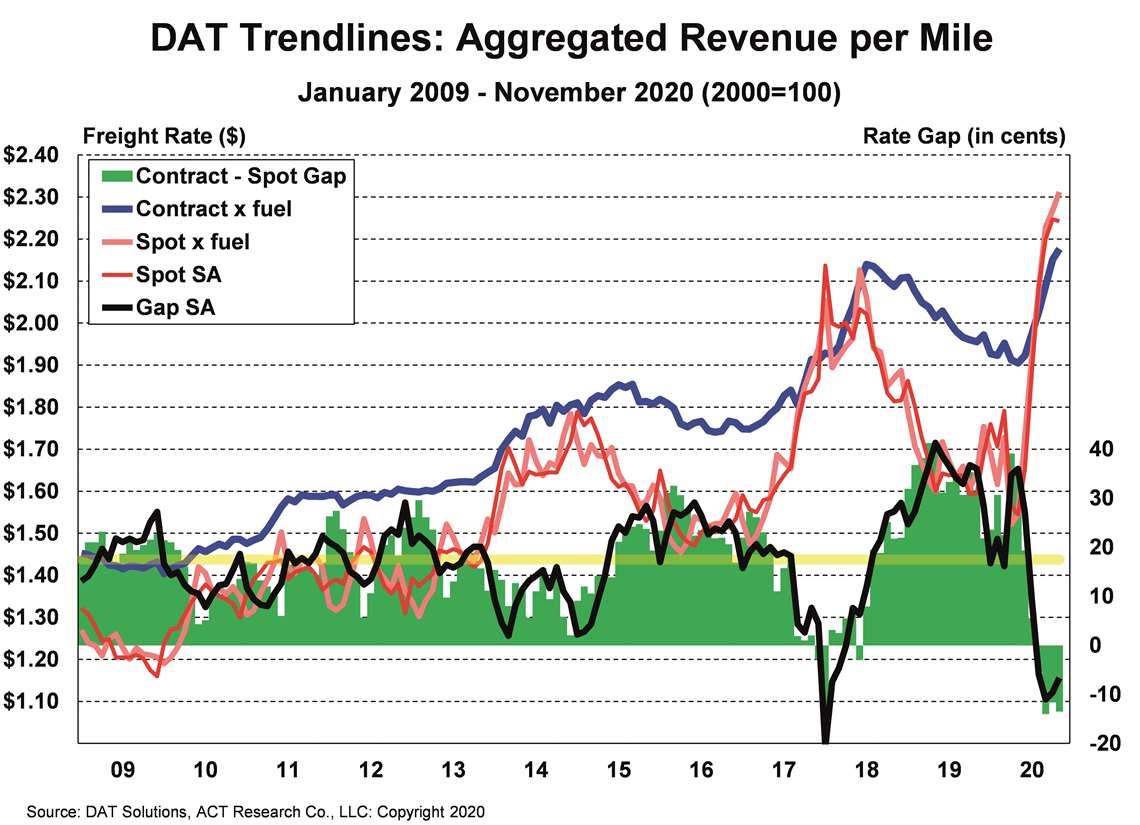

As illustrated in the accompanying chart showing ACT’s aggregation of DAT’s freight rate and fuel data, spot and contract rates have both risen to record territories. The rate spread inversion that began in August – spot rates above contract rates – is an indication that contract rates, and by extension carrier profitability, have considerable upside potential into 2021. In the 10 years ending in 2019, the mean rate spread (contract minus spot) was +18 cents. Over the past three months, the spread averaged -13 cents. A reversion to the mean from here would suggest an additional 10% to 15% increase in contract freight rates.

While we start our review with freight rates, those rates are symptomatic of market conditions: Rates don’t rise in a vacuum, but in commodity-like fashion, are driven by the trucking industry’s ability to provide trucking services relative to the amount of freight to be hauled. While there is something different about every economic cycle, the difference this cycle was the pandemic’s impact on consumer and business spending, while simultaneously impacting the trucking industry’s ability to easily bring capacity online.

THE DEMAND SIDE

Typically, we do things. We get on airplanes, attend sporting events and concerts, go on vacations, stay at hotels, etc. And for business, the story is not that much different: substitute clients for concerts and business conferences for vacations. Instead of spending money this year on “experiences,” U.S. consumers and businesses spent money on goods. Considerable remodeling got done in 2020, and much technology got purchased.

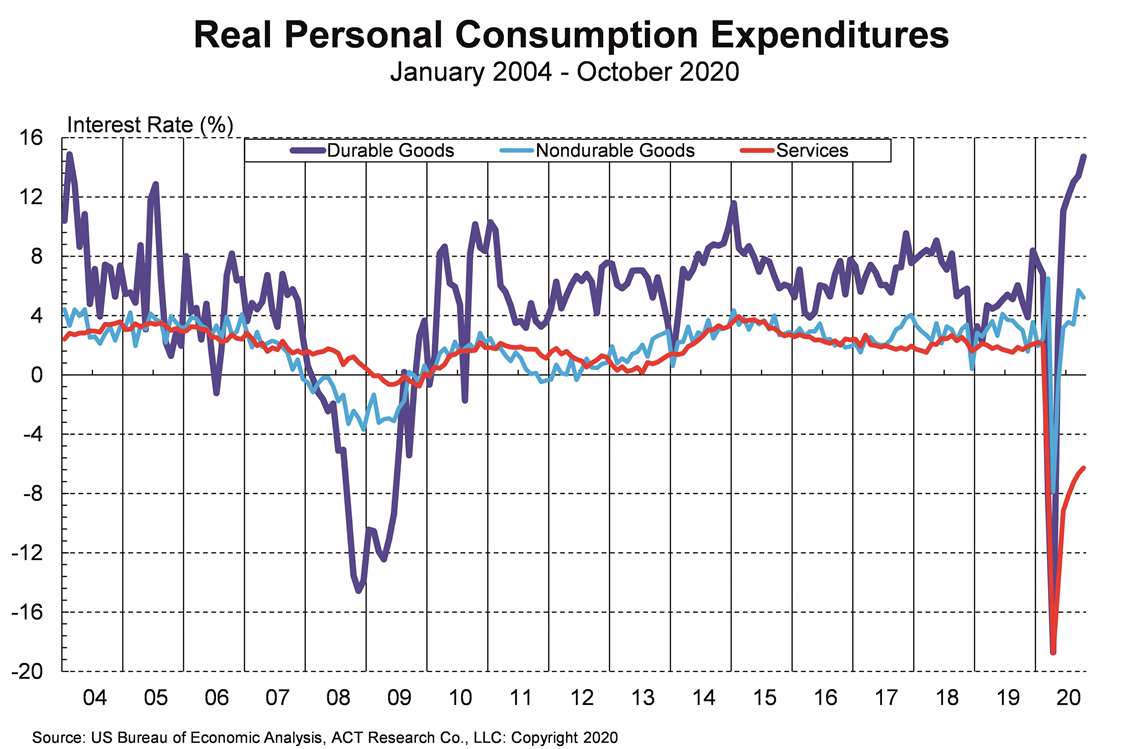

The consumer spending (PCE) chart illustrates where U.S. consumers were and were not spending their money. In October, consumer spending on durable goods was up 15% year over year (y/y), spending on nondurable goods was up 5%, while spending on services, traditionally the single largest piece of the U.S. economy, was down 7%.

While we anticipate this surge in consumer goods spending will moderate as the nation is vaccinated – who doesn’t want to go anywhere? – a robust economic outlook suggests that the freight pipeline will remain filled through 2021 and, barring the unforeseen, into 2022 as well. Here’s a look ahead.

Housing - New, used and remodels: Millennial generation demographics and low interest rates are providing fuel for an explosion in all things housing.

Manufacturing: We typically look for manufacturing to put the “C” in the demand cycle, especially for heavy vehicles. Upswings in forward-looking metrics suggest the manufacturing sector will reengage after two years of weak results.

Business inventories: The hard stop in the global economy in the spring, coupled with the aforementioned surge in goods spending, has left business inventories 5% below year-ago levels, ensuring that restocking will keep freight markets active early in 2021.

Savings: While consumers spent a lot on goods in 2020, they also set aside considerable rainy-day funds. Compared to a long-term 8% savings trend, over the past 12 months savings have surged to 15%.

THE SUPPLY SIDE

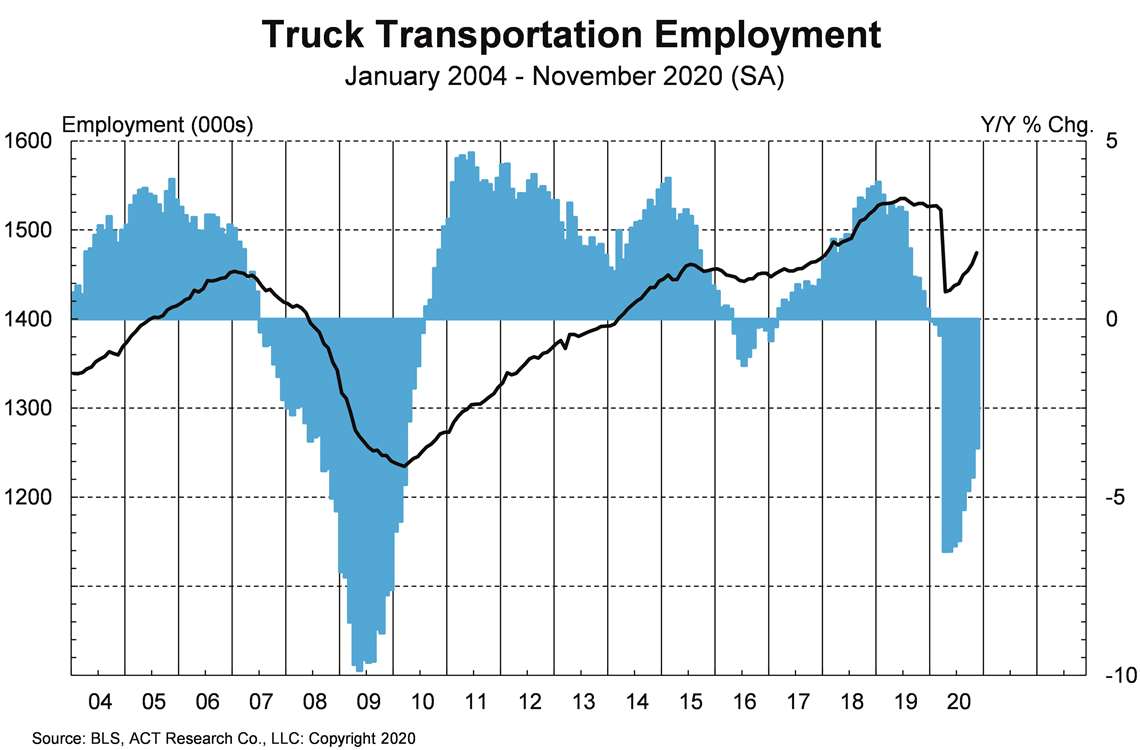

While it has been something of a chronic problem, drivers have become increasingly hard to find. Despite the goods economy surging in 2020 and a robust goods pipeline extending into 2021, the data show that drivers are returning to the industry, if slowly and despite rising wages.

Illustrating the “supply-side” challenge facing shippers today, for-hire trucking companies shed about 6% of driver capacity in April (-6.5% y/y). In November, driver employment was still 3.6% below its year-ago level, with the long-haul segments still down more than 5%.

The question we wrestle with is, how fast does the driver capacity shortfall right itself? There are a number of challenges, regulatory and structural, that suggest driver shortfalls around economic inflections will become increasingly difficult to overcome. While that is a longer-term challenge, there are two issues that have impacted the industry’s ability to easily add capacity in the current market:

Training: During the quarantine, driver schools and DMVs were closed, shutting off the supply of new drivers for several months. Upon reopening, social-distancing measures limited the number of students in training.

Regulatory: In January 2020, the FMCSA’s Drug & Alcohol Clearinghouse, a nationalized database of violations, went into effect, thus eliminating a driver’s ability to go to another state after a failed drug or alcohol test. Through October, the clearinghouse had taken nearly 43,000 drivers off the roads, 70% of whom had not started the “return to duty” process.

Structural: Truck driving has become a second-career vocation. With Baby Boomers being replaced by the smaller Generation X, the target truck-driving demographic is contracting.

THE INFLECTION POINT

With consumer spending on goods underpinning freight volumes and freight rates in the second half of 2020, carrier profits are rising sharply. To our opening point, whether you are hauling freight in a heavy truck or you are schlepping e-commerce packages in a last-mile operation, your business was surging as 2020 ended and freight rates, already at record levels, are expected to remain high amidst constrained labor supply.

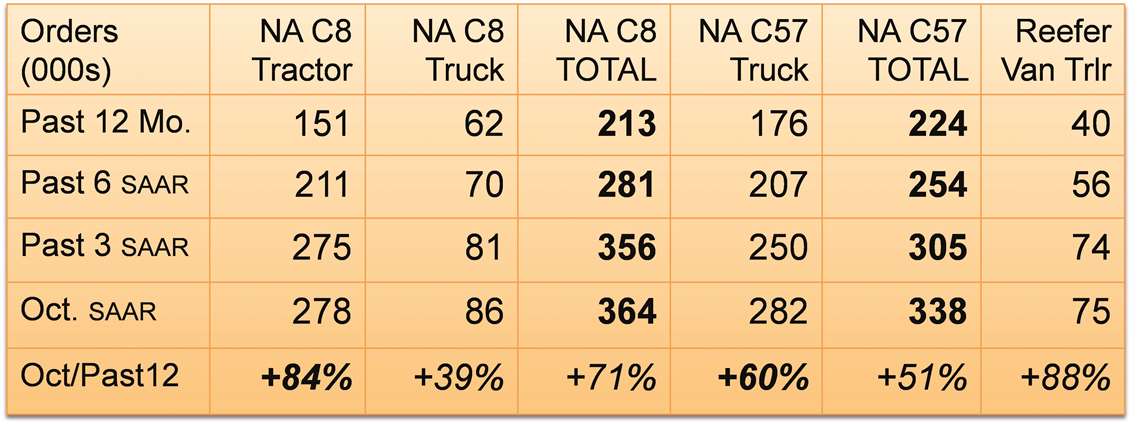

That paragraph is reflected across the board in recent commercial vehicle orders. Starting in September, orders for Class 8, for Classes 5-7, and for trailers moved sharply up and to the right.

The order table captures the surge in activity over the past few months. The data are shown in seasonally adjusted annualized rates (SAAR). As can be seen, comparing orders in October to orders booked in the 12 months ending October, improvements range from +51% for North American Classes 5-7 vehicles to +71% for the North American Class 8 market to 88% for the U.S. reefer trailer market. Drilling down to the freight-hauling pieces of the market, Class 8 tractor orders were up 84% and medium-duty truck orders rose 60%.

At this writing we were days from having official November statistics, but it can be said, on a preliminary basis, that Class 8 orders were at their third-best order volume of all time, and the medium-duty market continues to build on recent strength. From September to November, North American Class 8 orders are projected at a 459,000 SAAR, with North American Classes 5-7 at a 335,000 SAAR. Looking forward from here, we would expect the order surge to continue through the first quarter of 2021, before moderating in the second quarter due to most of 2021’s orders already being booked.

Surging orders have already triggered significant backlog growth. We anticipate that the order surge will continue for several more months, as carriers and dealers get in the queue of folks looking to acquire a vehicle in 2021. With backlogs rising, the challenge for the industry in 2021 is ramping up to meet demand. Our forecasts, especially for Class 8 and reefer vans, are more related to the industry’s ability to ramp-up to meet demand, rather than for what truckers are asking. If the industry can build more in 2021, there is an appetite for that extra capacity.

Overall, we anticipate that still-strong carrier profits and some level of pent-up demand for equipment will provide sufficient support into the end of 2021, and that the demand for commercial vehicles will carry a full head of steam into 2022.

ABOUT THE AUTHOR

Kenny Vieth is president and senior analyst at Americas Commercial Transportation (ACT) Research Co., LLC. ACT is a global publisher of commercial vehicle industry data and forecasting services based in Columbus, Ind.

Tel: (812) 379-2085

Fax: (812) 378-5997

www.actresearch.net

Email: [email protected]

This story first appeared in the January issue of Diesel Progress. For a free subscription, click here.

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

POWER SOURCING GUIDE

The trusted reference and buyer’s guide for 83 years

The original “desktop search engine,” guiding nearly 10,000 users in more than 90 countries it is the primary reference for specifications and details on all the components that go into engine systems.

Visit Now

CONNECT WITH THE TEAM