Record construction equipment sales in 2021

16 March 2022

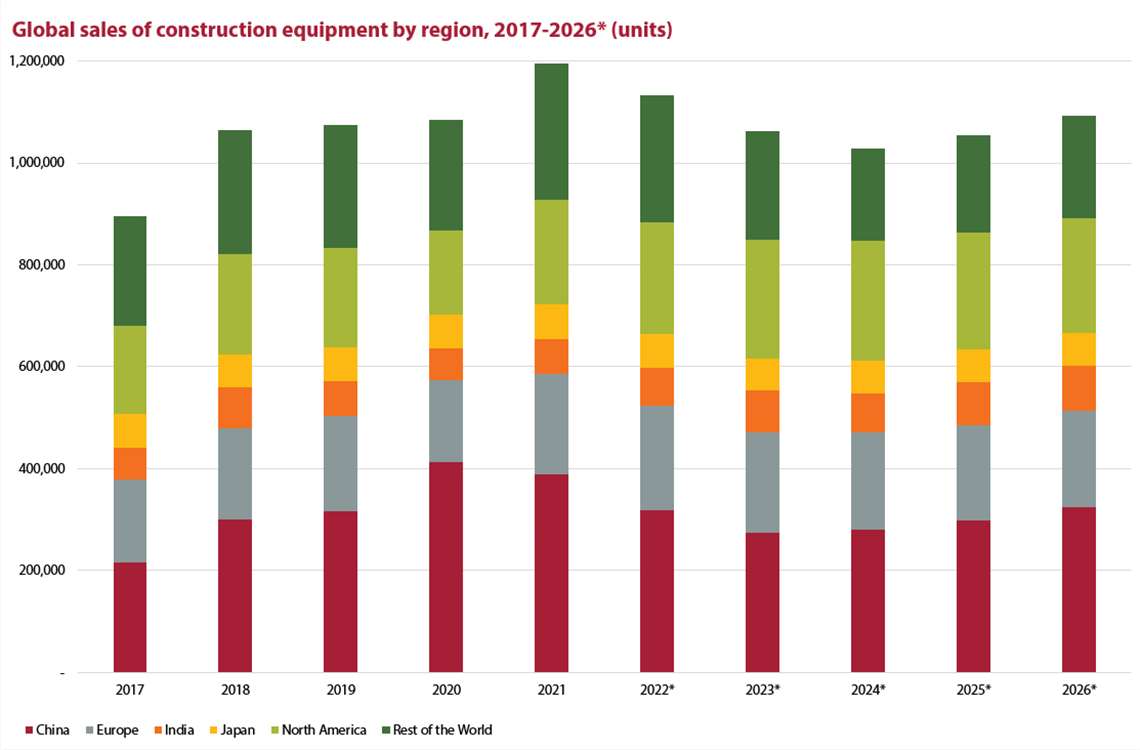

Global construction equipment sales rose 10% in 2021 to a new record of 1.196 million units, according to Off-Highway Research’s newly updated Global Volume and Value Service.

A fall in demand of around 5% is expected this year, but that would still give 2022 the second highest sales volume on record.

Off-Highway Research managing director, Chris Sleight said, “The combination of low interest rates, stimulus spending on infrastructure and high commodity prices last year was a heady combination for the construction equipment market. Residential construction is booming, there is strong demand for equipment from mines and the pipeline of infrastructure work looks solid.”

All major markets of the world grew last year, with the exception of China. Some of the most robust growth was seen in North America (up 25%) and Western Europe (up 22%), while emerging markets, excluding India and China, were up 24%.

Sleight said, “Equipment sales in China have moved to a different rhythm to the rest of the world since the start of the Covid pandemic. China quickly put stimulus in place at the start of the global pandemic in March 2020. As a result it saw 30% growth in its equipment sales last year, to take the market to volumes which had not been seen for a decade.

“However, this stimulus push was soon spent and equipment sales started to fall in the second quarter of 2021. Although the downturn was steep, the extremely high volumes of equipment sold in the first quarter had an offsetting effect, and the market as a whole fell only -6% overall in 2021.”

The outlook for 2022 remains upbeat, with further equipment sales growth expected in many countries, again with the exception of China.

Global demand for construction equipment is higher than supply – a situation not helped by shipping bottlenecks, a shortage of skilled workers and other supply chain issues. Many manufacturers have reported that they are sold out for 2022, so global equipment sales should stay at high levels throughout the year, although challenges for the industry remain.

“Inflation and the prospect of rising interest rates have been factors for several months and could be a brake on growth,” added Sleight. “More recently, Russia’s invasion of Ukraine and the resulting international sanctions have exacerbated this situation. It is too early to say how the geopolitical and economic factors will play out, but there are clearly no positives to draw from such a dreadful situation.”

Results from last year and the company’s updated outlook will be discussed in the Global Off-Highway Briefing webinar on 29th March. More details are available on a dedicated website.

Book your place with a credit card payment on the Off-Highway Research online store here. If you need to pay by American Express, please book via the KHL online store here.

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

POWER SOURCING GUIDE

The trusted reference and buyer’s guide for 83 years

The original “desktop search engine,” guiding nearly 10,000 users in more than 90 countries it is the primary reference for specifications and details on all the components that go into engine systems.

Visit Now

CONNECT WITH THE TEAM