Companies positioning to ramp up production of advanced electrolyzer solution

Fully integrated engine version for U.S. Army development program has begun testing

New encoder suited for harsh outdoor mobile equipment applications

Nevada distribution center to be consolidated into Indiana campus

Severe conditions seen throughout the UAE, with flooding in Dubai

Reductions part of reorganization announced in November 2023

Sponsored Content

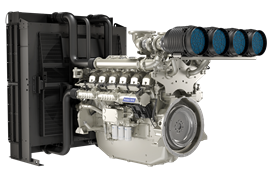

See why the compact but mighty John Deere 4.5L Stage V industrial engine was the right solution to power Gunnar Guldbrand A/S’s custom truck solution for horizontal directional drilling customer Eco Drilling.

In this second installment of a three-part series on what makes a facility “state-of-the-art,” we examine a philosophy related to cutting-edge plant floor technology: smart manufacturing.